Bitcoin Market Intelligence - Issue #21 - An update on on-chain metrics

Hey everyone,

with the latest price gains of Bitcoin and sentiment potentially shifting, I think it is time to look at some on-chain metrics again and see how they evolved over the last weeks. So let’s dive right in.

——————> Zum Deutschen Newsletter geht es hier. <——————

After moving sideways in December or even partially downwards, the number of addresses with a non-zero bitcoin balance started to increase again towards the end of January in a relatively substantial way.

It is important to point out that these are addresses and not users/entities. So it can be new users and people increasingly stacking sats on the latest price move to newly generated public addresses. The latter is probably the biggest factor, I would say.

At least, I would be surprised that, on the latest price recovery, many new users are jumping in. That rather happens at the late stage of a bull run when the hype is high. So it is more likely that people who have been watching the space are scaling back in or are increasing their stacking activity.

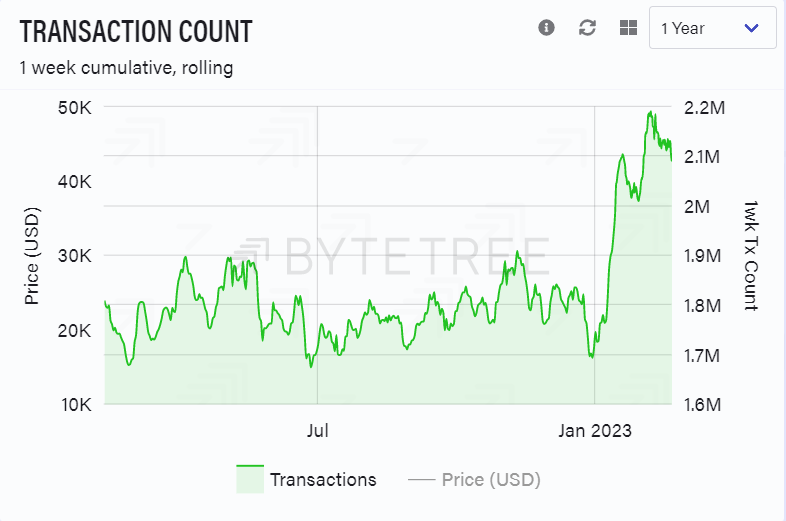

We also see that transactions on-chain have increased substantially this year, with weekly transactions increasing from 1.7 million at the end of December to over 2.1 million transactions now.

Ordinals that gained a lot of attention over the last weeks may play a role in the latest increase towards the beginning of February, with currently about 130.000 ordinals existing on the bitcoin network. But the biggest increase happened in the weeks before that. The impact of ordinals may also be seen in the afore-mentioned metric (number of addresses with a non-zero balance).

.

However, while the number of transactions is up substantially, the total value transacted on-chain has hardly increased this year.

The rather low activity can also be observed when looking at spent volumes of coins on-chain. The spent volume of medium to long-term-aged coins only increased slightly at the end of January, but it has remained flat apart from that. Spent volume by young coins (1 week to 6 months) has also not been abnormally high.

The supply last active 1+ years ago has hardly declined in January and is instead close to new all-time high levels at the moment, not far away from 67%. Long-term holders are sticking to bitcoin, regardless of whether this is the start of the next bull run or just a price relief rally in a bear market

Summing up: Addresses with a non-zero bitcoin balance and the number of transactions on-chain have increased substantially this year. Meanwhile, the transfer volume on-chain has hardly increased, the same as spent on-chain volume looking at different aged coins.

That points towards increased stacking activity by people already in the space and potentially less so by new users, overall activity in terms of economic relevance still remains low. Which, all in all, is not surprising.

While this may well be the start of the next bull run, there is still very high uncertainty around that. Market participants may underestimate the willingness of the Fed to fight inflation, the short-term effects of a potential recession are not factored in etc.

So, on the one hand, you have those jumping in that believe the bottom is in or that buy regardless of what happens in the short term and then you have those that may still be sitting on the sidelines. The latter is a risky long-term play if you are convinced that Bitcoin is the future, however.

For the next newsletter, you may have to wait a bit longer than two weeks as I am on holidays around that time. Please don’t burn it all down while I am away. ;-)

Jan Wüstenfeld

If you found this newsletter insightful, don’t forget to subscribe and share it. You would make my day! :-)

Thanks for reading Bitcoin Market Intelligence (English)! Subscribe for free to receive new posts and support my work.

————————————————————————————

This content is for educational purposes only. It does not constitute trading advice. Past performance does not indicate future results. Do not invest more than you can afford to lose. The author of this article may hold assets mentioned in the piece.