Hey everyone,

Don’t be surprised if you are now receiving the English newsletter via Substack. I had to migrate it from Revue to Substack as Revue, unfortunately, has been shut down this month. But anyway, having both newsletters on the same platform is also not too bad.

——————> Zum Deutschen Newsletter geht es hier. <——————

I hope you had a great start to the new year. Bitcoin certainly did. In fact, it was a phenomenal start. Its price is up by almost 40% this year, recovering all the losses from the FTX crash.

Market participants are anticipating a slowdown in monetary tightening or even monetary easing (a pivot) this year and are interpreting this as bullish, at least for now. The Nasdaq-100 is also up this year by 9% and the S&P 500 by 4%.

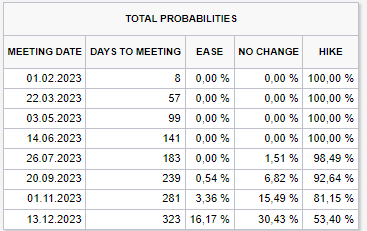

Considering the CME FedWatch Tool, the probability of the Fed easing increases in November and December. Still, it is less likely than no change (the Fed keeping rates at an elevated level).

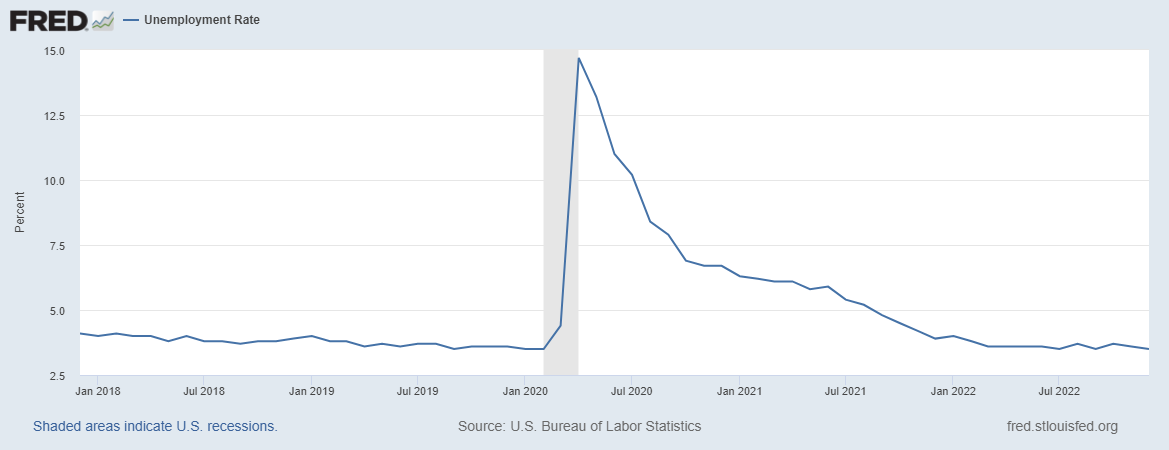

Given current economic data, I think that calls for a Fed pivot are still a bit premature. While we are increasingly seeing headlines of layoffs in the tech industry, the unemployment rate remains low in the US (3.5%).

One could argue the tech industry is the canary in the coal mine and that the US ultimately will slide into a recession. In this case, however, we have yet to see the unemployment rate pick up. If we are seeing a recession, I would at least expect it to be a few months away, pushed out to the end of this year or even into 2024.

I have written about one recession indicator in the previous issue, which is the yield curve inversion of the 10-year to 2-year yield curve, which is inverted. But as I show, it takes quite a long time before the Fed starts lowering interest rates following a yield curve inversion.

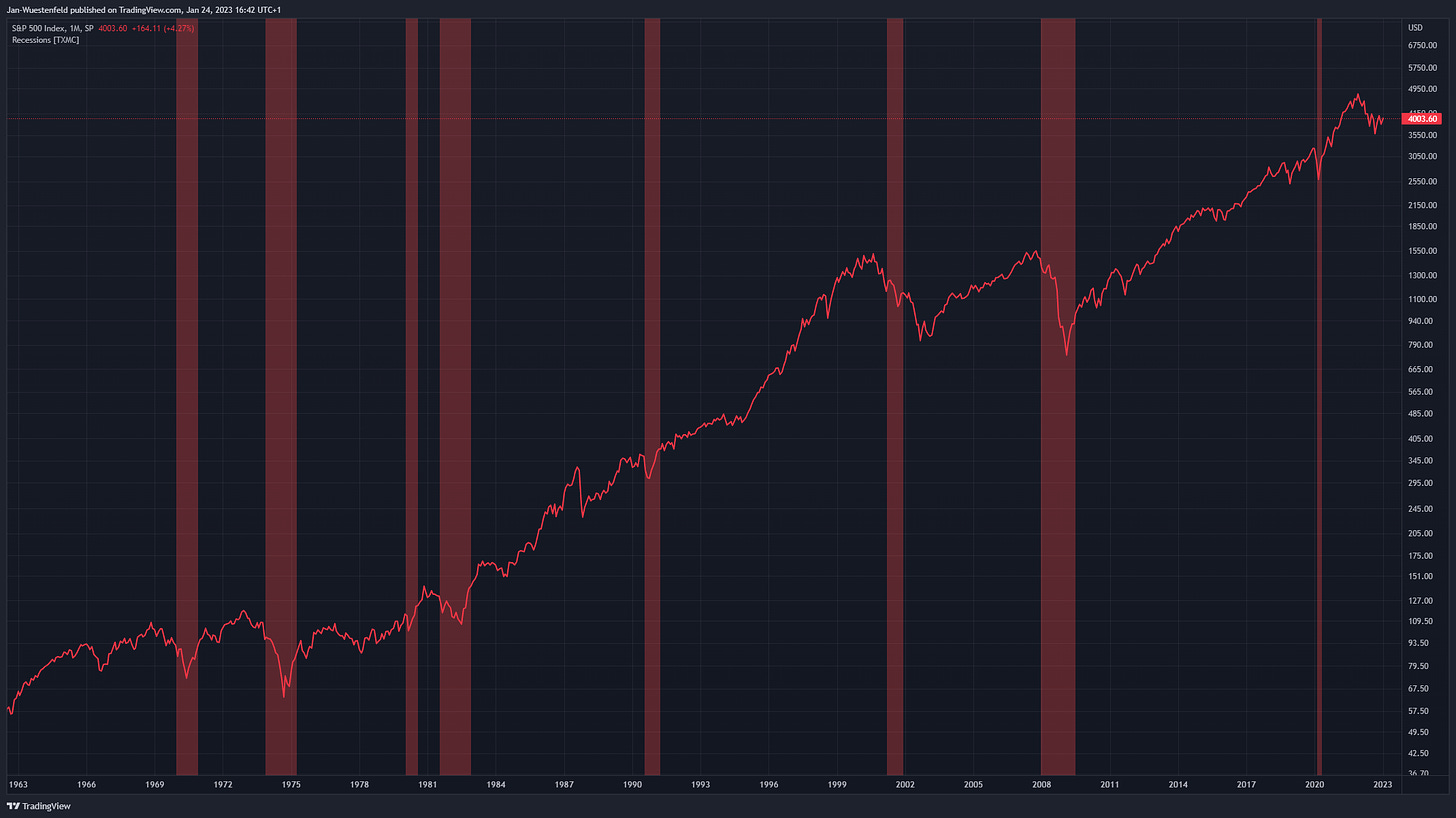

While a recession ultimately means that the Fed has to ease monetary policy and lower interest rates, this rather negatively affects financial markets in the short term.

But the low unemployment rate despite monetary tightening could also mean that the Fed may actually be able to create a soft landing. In that case, monetary easing would be far away.

We must wait for more incoming economic data, e.g. if the unemployment rate rises.

I currently see the following scenario as the most likely for the Fed:

A few more rate hikes until they have reached the terminal rate: currently expected terminal interest rates of 5-5.25%; now, we have interest rates of 4.25-4.5%.

The year-over-year inflation rate in the US is slowing but remains elevated. So even after the Fed has reached its terminal interest rate, I expect the Fed to keep rates at an elevated level to let interest rates take effect and to observe where the inflation rate is headed. The effect of higher rates on inflation is usually seen with a lag. I would say they worry more about easing prematurely and, with that, fuelling inflation than supporting the economy with easy money should economic data start to deteriorate. That worry might indeed be real. For instance, Incrementum Inflation Signal is showing rising inflation momentum this month.

Due to this, I expect them to react slowly; yes, they are always slow, but even slower than normal if economic data worsens. One thing to consider here is also that economic data comes in with a lag, so that’s why by design, they are slow in reacting to changes.

However, the market does not appear to believe my outlined scenario from above.

Maybe we will see the Fed starting to ease near the next Bitcoin halving cycle, which is projected to happen in April/Mai 2024. This would be perfect timing for Bitcoin.

Keep in mind 2023 is particularly hard to predict. We are currently seeing easing inflation pressures, still a relatively strong labour market and more. These can change in a blink of an eye. We can mainly hypothesise what happens if things change and merely form a hypothesis about where things are headed.

Particularly this year, the finance community seems to be divided on where markets and the economy are headed and how the Fed will react to that.

I am interested to hear your thoughts on this, even if you completely disagree with me and why. Where do you see inflation this year? Will we see a recession in the US? Will the Fed pivot? What does that mean for Bitcoin?

Jan Wüstenfeld

If you found this newsletter insightful, don’t forget to subscribe and share it. You would make my day! :-)

————————————————————————————

This content is for educational purposes only. It does not constitute trading advice. Past performance does not indicate future results. Do not invest more than you can afford to lose. The author of this article may hold assets mentioned in the piece.

Thanks, this is the best I’ve seen on FED, keep up the good work.

Thanks for sharing mate. Welcome on Substack 🤝